Therefore, in LIFO reserve equation, the value of cost of goods sold will be the cost of the inventory that is used first. LIFO reserve accounting is a concept in the books of accounts that explains the difference between the cost of the closing inventory calculated using LIFO method and the cost of closing inventory derived form FIFO(First In First Out) method. The above are two different but widely used procedures for evaluation of closing balance of inventory.

Adjusting the Financial Statements

In summary, while the LIFO reserve impacts financial statements and ratios, its effects should be considered carefully regarding the true, economic financial position. Adjustments are often required to realign inventory valuation and operating results to actual replacement costs. Since the most recent costs are expensed first under LIFO, COGS is lower compared to other methods like FIFO. However, the benefit is essentially “artificial” since the outdated historical costs reflected do not represent current inventory replacement costs. The LIFO Reserve is an important accounting calculation mandated by the US GAAP and FASB.

LIFO Reserve Journal Entry

Gross profit of $1.7 billion increased by $125 million, or 8.1% from the prior year, primarily as a result of an increase in total case volume, improved cost of goods sold, pricing optimization and a favorable year-over-year LIFO adjustment. Adjusted Gross profit was $1.7 billion, an increase of $111 million or 7.0% from the prior year. On the balance sheet, the inventory value is reduced by the amount of the LIFO reserve. This is because the LIFO method tends to understate ending inventory on the balance sheet by valuing it at older, lower historical costs rather than current replacement costs. It reflects the amount by which inventory is undervalued relative to actual price levels.

The Importance of LIFO Reserve in Business Accounting

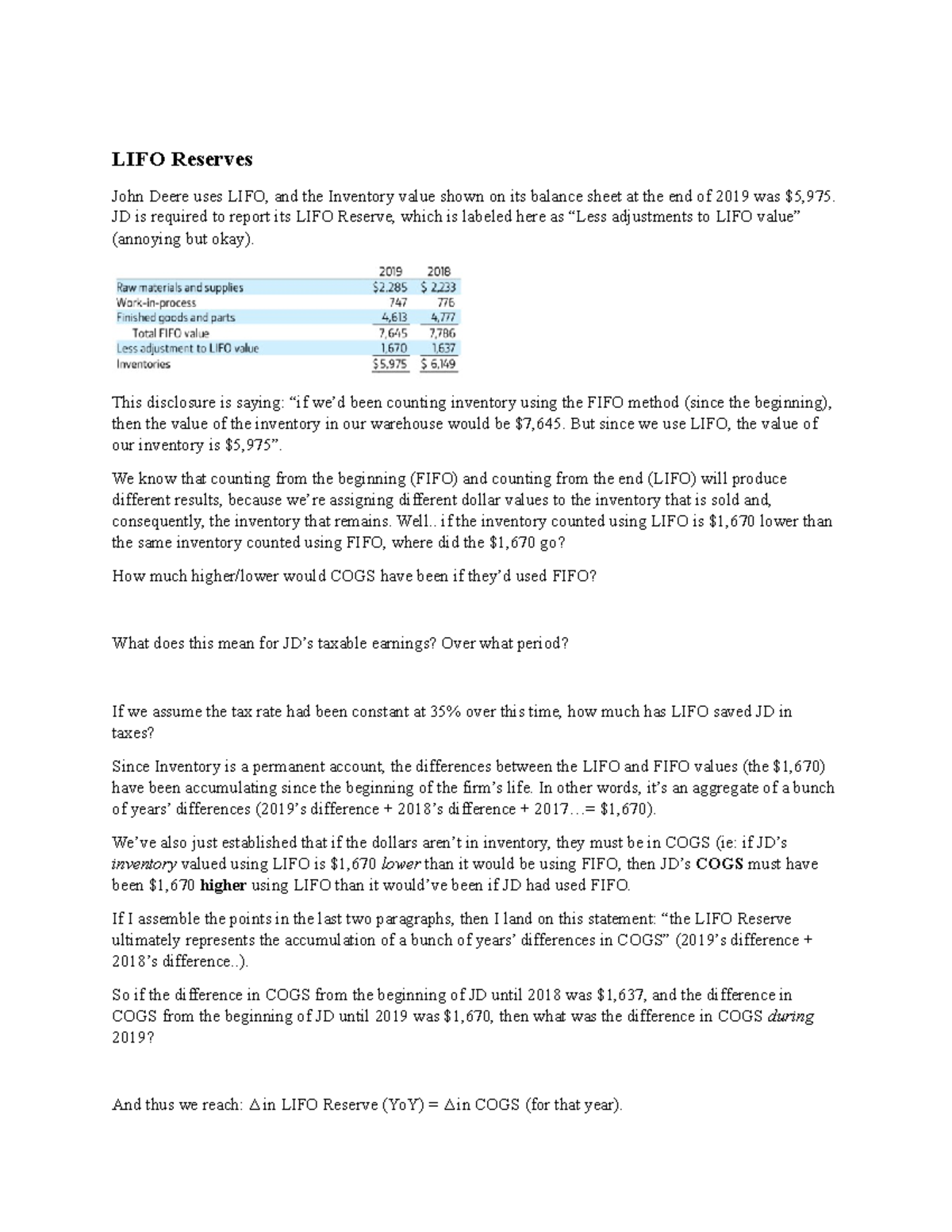

LIFO reserve is the difference between what the company’s ending inventory would have been under FIFO accounting and its corresponding value under LIFO accounting. Companies that use the LIFO Inventory method are required to disclose this reserve which can be used to adjust the LIFO cost of goods sold and closing Inventory to their FIFO equivalent values to make it comparable. Considering the impact of current market conditions tempered by ongoing investments in growth, in fiscal 2025 the Company expects low-single-digit topline growth and mid-single-digit adjusted EBITDA growth compared to fiscal 2024. The Company plans to provide its full fiscal 2025 outlook when it announces its fourth quarter and fiscal 2024 results in February 2025. A reconciliation of long-term debt and finance lease obligations to net long-term debt and Net Earnings to Adjusted EBITDA, non-GAAP financial measures, are provided in Table 4. Adjusted Diluted EPS is calculated as Adjusted net income divided by weighted average diluted shares outstanding (Non-GAAP).

- The combined impact is an increased COGS and reduced net income, which can increase tax liability.

- Disclosure about LIFO reserve is important in such scenarios for comparability of financial results.

- Adjusted Diluted EPS is calculated as Adjusted net income divided by weighted average diluted shares outstanding (Non-GAAP).

- It reflects the amount by which inventory is undervalued relative to actual price levels.

- By understanding the LIFO reserve formula, you can accurately calculate this inventory adjustment to comply with accounting standards and provide investors transparency into your business.

This is specifically important when sharing things like tax returns with the government because it means the amount of taxes the company accrues is likely to be lower. LIFO Reserve is an accounting entry that companies using the LIFO method must maintain. It represents the difference between the inventory’s reported value on the balance sheet under LIFO and what the inventory’s value would be under FIFO. We can further calculate the FIFO Cost of goods sold from the FIFO Inventory to find the gross profit and profitability ratios. Over 1.8 million professionals use CFI to learn accounting, financial analysis, modeling and more.

AccountingTools

This method is quite popular in the United States and is allowed under US GAAP (LIFO Method is prohibited under IFRS). Companies opting for the LIFO method of Inventory are required to disclose Last in First Out Reserve in the footnotes of their financial statements. The income tax effect on adjustments is computed by applying the effective reporting and analyzing the income statement tax rate, before discrete tax items, to the total adjustments for the period. In this method of inventory, the cost of goods sold is calculated by starting with the latest goods bought. For instance, if you bought 100 lipsticks in week one at $10 each, 90 lipsticks in week two at $15 each, and you bought 150 in week three at $20 each.

Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career. It is important to realize that the LIFO reserve is sometimes referred to as excess of FIFO over LIFO cost, LIFO allowance, or revaluation to LIFO. We see through a hypothetical example how the formula can be used to calculate the reserve and liquidation example also explains the procedure to calculate the same.

At the end of the third quarter, the Company had approximately $398 million in remaining funds authorized under its $1 billion share repurchase program. In a persistently deflationary environment, the LIFO reserve can have a negative balance, which is caused by the LIFO inventory valuation being higher than its FIFO valuation. The LIFO reserve is a ledger account that records the difference between the FIFO and LIFO methods of the inventory report.

As the above entry shows, the value of COG rises due to higher value of the recent materials that will move out of the inventory stock first. The FIFO method of evaluating inventory is where the goods or services produced first are the goods or services sold first, or disposed of first. The LIFO method of evaluating inventory is when the goods or services produced last are the ones to be sold or disposed of first.

GAAP requires all businesses to report the LIFO reserve for bookkeeping purposes. LIFO reserve enables the stakeholders to compare the performance of any business without getting confused about inventory methods. Consequently it follows that as the change in inventory is a component of the cost of goods sold, the other side of the double entry posting is to the cost of goods sold account. Assuming prices are increasing, the FIFO valuation of inventory will therefore be greater than the LIFO valuation. This reserve is mainly used for taxation purpose in US because it allows companies to defer the tax payments as mentioned above.

Since the accounting profession has discouraged the use of the word “reserve”, the inventory notes in the financial statements have descriptions such as Revaluation to LIFO, Excess of FIFO over LIFO cost, and LIFO allowance instead of LIFO reserve. This is advantageous in periods of rising prices because it reduces a company’s tax burden when it reports using the LIFO method. A reconciliation of net earnings to adjusted earnings from continuing operations, as well as per diluted share (“adjusted EPS”), a non-GAAP financial measure, is provided in Table 3. Definitions and reconciliations of the non-GAAP financial measures to their most comparable GAAP financial measures are included in the schedules attached to this press release.